In business, “G&A” and “overhead” are terms often used when discussing costs. While some people believe these terms mean the same thing, they are not exactly identical. It is important to understand the differences between G&A and overhead costs, as well as how they fit into a company’s operating expenses. So what is the difference between overhead and G&A? Let’s find out.

Is Overhead the Same as G&A?

Overhead and G&A are sometimes used interchangeably, but they are not exactly the same. Both terms refer to costs that are not directly tied to the production of goods or services. However, G&A, which stands for “General and Administrative” expenses, is actually a specific part of overhead.

What is the difference between overhead and G&A?

Overhead refers to all the indirect costs needed to run a business, while G&A is a subset of those costs, focusing more on the expenses related to the general management and administration of the business.

For example, overhead can include expenses like rent, utilities, and maintenance. G&A, on the other hand, includes expenses such as bank charges, bookkeeping fees, office supplies, and insurance fees. Both are essential for a business to function, but they cover different types of costs.

The Difference Between Overhead and Operating Expenses

While overhead and G&A costs can overlap, it is also important to understand the difference between overhead and operating expenses. Operating expenses refer to all the costs associated with the day-to-day operations of a business. This includes both direct and indirect costs. Direct costs are the ones directly linked to the production of goods or services. Indirect costs are the ones necessary for the business to function but are not directly tied to production.

Overhead expenses are considered indirect costs because they are not directly related to making products or services. However, they are part of operating expenses, alongside direct costs. So, while all overhead costs are operating expenses, not all operating expenses are overhead costs.

A useful example to illustrate this would be a manufacturing company. The company must pay for raw materials and labor to create its products—these are direct costs and part of operating expenses. At the same time, the company also needs to pay for the electricity to keep the factory running and the rent for the office space—these are indirect costs or overhead, and they also fall under operating expenses.

What Are General and Administrative Expenses in Overhead?

General and administrative (G&A) expenses are a category within overhead costs that focus specifically on the administrative functions of the business. These costs are not related to the production or sale of goods but are necessary to keep the company running smoothly. G&A expenses typically cover things like accounting expenses, the cost of insurances, office supplies, & bank charges. Other examples of G&A expenses include phone and internet bills.

Unlike other overhead expenses, which may be allocated to specific departments or projects, G&A expenses are generally spread across the entire business. They support the overall operations of the company, not a particular product or service.

In some businesses, expenses such as rent, utilities, and property maintenance are grouped under occupancy costs rather than G&A. Occupancy costs include the expenses related to maintaining physical spaces, like offices or warehouses, and are considered part of overhead. This approach helps distinguish between the expenses tied to the company’s physical premises and the broader administrative costs.

Examples of Overhead Costs

To further understand the differences between G&A and overhead, it is useful to look at examples of various overhead costs. As mentioned earlier, overhead costs are the indirect costs needed to keep a business running. These can include the following:

1. Rent: The cost of renting office space, factories, or warehouses is considered an overhead cost.

2. Utilities: Electricity, water, and heating are necessary to keep the business operating but are not directly tied to the production process.

3. Insurance: Business insurance, such as liability insurance or property insurance, is another overhead cost.

4. Maintenance: The upkeep of the office, machinery, and other equipment also falls under overhead.

5. Depreciation: Depreciation is the gradual reduction in value of assets like machinery or vehicles and is considered an overhead expense.

While these are all overhead costs, only some of them would be considered G&A expenses. For example, the insurance for the business would be a G&A expense, while the maintenance of a factory would be overhead but not G&A.

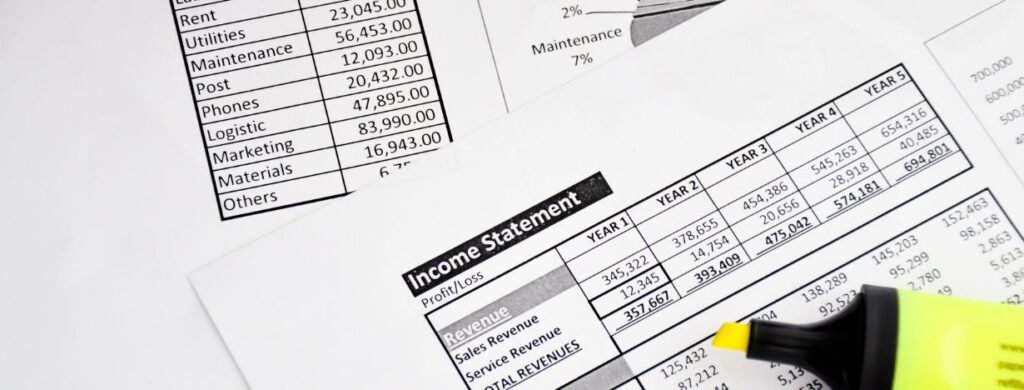

Overhead and the Financial Statements

In financial reporting, companies must accurately allocate their overhead costs to understand the true cost of running the business.

For a business to remain profitable, it is essential to manage overhead costs effectively. High overheads can eat into profit margins, making it harder for a company to succeed. By keeping a close eye on both manufacturing and non-manufacturing overhead, businesses can better control their expenses and improve their financial performance.

Managing G&A and Overhead Costs

Both G&A and overhead costs need to be managed carefully to ensure a company’s long-term success. Since these costs do not directly contribute to revenue generation, companies must find ways to keep them under control without sacrificing the efficiency of the business.

One common strategy for managing G&A expenses is to outsource non-core functions, such as IT support or accounting, to external service providers. This is something that I did with my business. This can be more cost-effective than hiring full-time staff for these roles. Another strategy is to invest in technology that automates certain administrative tasks, reducing the need for large administrative teams.

Managing overhead costs, on the other hand, might involve negotiating better contracts with suppliers or finding ways to reduce utility costs. For instance, installing energy-efficient lighting or upgrading to more efficient equipment can help reduce utility expenses, which are part of overhead.

Summing Up

G&A and Overhead—Related but Not the Same

In summary, while G&A and overhead costs are related, they are not the same. Overhead refers to all indirect costs needed to run a business, while G&A is a specific type of overhead focused on general management and administration. Additionally, both G&A and overhead costs are part of a company’s operating expenses, but they are distinct from direct costs associated with production.

By understanding the differences between these terms and how they are used in financial reporting, businesses can better manage their costs and improve profitability. Properly managing both G&A and overhead costs is crucial for maintaining a healthy bottom line.