The Number 1 reason why businesses fail is:

Inadequate Cash flow or high cash use

These are some simple tips and guidelines on how to get your cash flow under control.

will take about 9 minutes to read….

What is Cash flow?

Put simply cash flow is the movement of money in and out of your business. You should always maintain a positive cash flow in your business so that you are able to meet your financial obligations. There are many factors that contribute to a positive cash flow and some simple things you can do to keep your business afloat. We look at these below.

Why is Cash flow important?

Cash flow is necessary so that your business is able to operate and pay its day-to-day expenses. This is also known as operating cash flow. This sort of cash flow is generally generated from your normal operations and sales.

Cash flow is also important when planning and looking into the future. If you are looking to expand or buy new and innovative machinery for example you would then consider a cash flow from financing. Financing cash flows generally come in the form of a loan.

How to maintain good cash flow

We take a look at some tips and guidelines below on how to maintain a good cash flow for your business.

Create Hidden Bank Accounts

No, i do not mean on a secret remote exotic island, it’s actually in your bank account, its just hidden. It’s an amazing feature!

If this is the only piece of advice you take from my experience, I would have served my purpose in assisting your business greatly.

This is how it works:

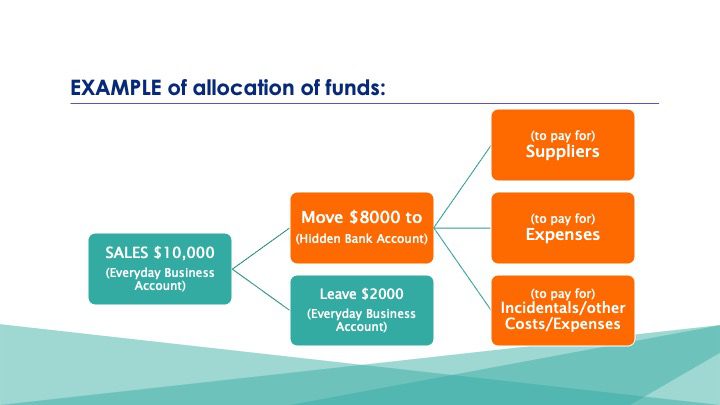

You will need two business bank accounts. You will use one of them as your everyday business account and the other as your hidden account.

Funds come into your everyday business account from your sales. Your business account is growing by the minute. However not everything is yours to play with. You need to manage your revenue. Let’s say your daily sales are $10,000 and from this your expenses are $8000. You would then move the $8000 from your everyday business account into the hidden bank account so you know you have your costs / expenses covered, and leave the remaining $2000 in your everyday business account.

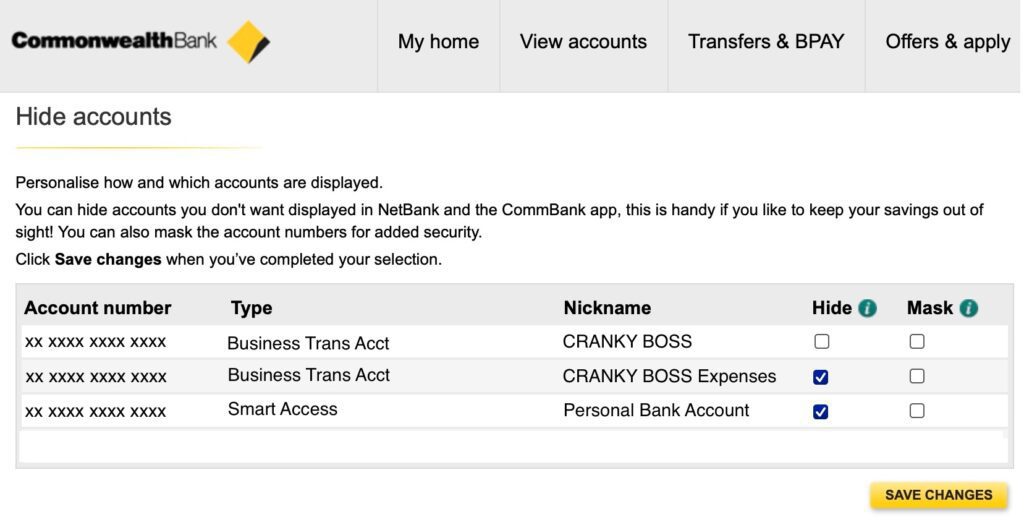

Some banks (like the CBA) have a hidden account feature on their banking platform, so when you login you will need to click on these hidden accounts to see them. They do not appear automatically nor do they show as available funds and thats the amazing part about them. With a simple click you can hide them and unhide them. If your bank doesn’t offer this feature, consider just opening a separate/second business account with a different bank. That way you have another account to move your funds into, and this account can be essentially out of sight. You will achieve the same result.

(See below snapshot of Commonwealth Bank feature that allows you to hide bank accounts:)

My hidden bank accounts were the single most important tool I had, in keeping cash flow and finance issues at bay. It was money I knew I simply could not touch. In fact, I trained my brain to forget about them. Out of sight and out of mind!

Starting a Business

New in Business? Have a business plan. Get a realistic view on what your start-up costs are and then add some more. (I had a customer who spent 250K opening a brick-and-mortar store and had no funds to buy product! That’s like starting a bakery without flour. Our neighbour renovated a pole dancing studio but didn’t have enough money to install poles! That’s not a great way to start a supplier-buyer business relationship) Look at your marketing budgets. You don’t have to go big and break the bank. In fact there are some affordable strategies for small businesses that you may not have thought of.

Operating Expenses

You should ideally be able to cover at the very least 3 to 6 months of operating expenses at any given time. (Operating expenses are generally things like rent, wages, utility bills – all those things you need to pay for every month, to keep your business running)

Profitability

Most people expect that they will start making money from day one when in fact profitability can take anywhere from 1 to 4 years.

Business Growth

Grow gradually and responsibly. You will need to initially put in a lot of time and effort to make your business work. Don’t rush to hire employees as tempting as it may be. Do as much as you can yourself. You will have to work ON and IN the business initially. Wait for your business to grow before going and renting a bigger or newer premises. When stock building, do it responsibly and gradually – you don’t want to tie up all your money in stock and have no cash flow left. Look at adopting strategies such as the JIT production strategy. When building my stock levels, I stuck to the best sellers which lowered my risk. I also never built up stock on more than 50% of what i sold the previous year. This was part of my risk management.

Business Spending

Spend no more than you can afford. Forget about that bleisure trip that you’re claiming as a business expense. There’s no point claiming it as an expense, if you simply can’t afford it. Give that money to your accountant – its better spent and it’s still an expense!

I will show you a free way to travel and it can be business or first class! ( finish reading this page first & then head on over……about 8 minutes to go)

Business Expenses

Look at your expenses regularly – trim some fat. There’s always something to cut.

Debtors & Credit

Try and avoid giving credit to your customers if you can. If it is a must, shorten the amount of time that they pay you or negotiate the terms. For example, rather than giving a credit of 30 days, give a dollar amount credit together with a 30 day credit and whichever comes first. That means if they finish their $ amount in 7 days, you could retrieve your money faster, rather than waiting for the month to end.

Invoicing

Get your invoices out – I have seen many people not get paid, simply because they don’t find time to raise invoices. There is great accounting software out there that can assist you with this or integrate it with your bookkeeping. Examples are MYOB, Xero, Quickbooks. Remember, if you don’t invoice, you don’t get paid, and getting paid is your priority; it will help maintain your cashflow.

Cash Flow Assistance

If you need cash flow assistance talk to your bank about which line of credit may assist you. In my experience a bank overdraft was the best option in terms of flexibility and rates. Keep away from credit cards for cash flow issues as their interest rates are very high and this could land you in even bigger trouble. Stay away from high interest lenders.

Cash Flow Forecast

A cash flow forecast is a simple method that gives you an idea of what’s coming and what’s going at any given time. Record the frequency of your expenses and set aside funds for when they are due. (For example: If your work safe bill is $12,000 and paid annually then set aside $1000 per month. If you have just 3 more of these sorts of bills that you don’t plan for, that’s a total of $36,000 that could come all at once and it could spell disaster. In fact, it could wipe you out if you are a small business.)

CASH FLOW PROBLEMS CAN CREATE THE FOLLOWING ISSUES THAT YOU WOULD WANT TO AVOID:

- Unpaid staff wages & super & accrued entitlements

- Trade issues – you won’t be able to buy stock or inventory

- Difficulty paying debts – resulting in bad credit ranking

- Issues with suppliers – you will get blacklisted

- Bad reputation – no one will want to do business with you and you will have a major risk of supply chain distribution

Inadequate Cash Flow or High Cash Use is the number one (out of the top four) reasons why businesses fail.

Let’s check out the other reasons why businesses fail & see more information on each:

It’s essential to understand these four reasons as they have critical information to the success of your Finances and Strategic Management which is one of the most important steps in the 5 basic step guide to running a successful business.